La notion de patrimoine semble évidente, tant pour un juriste qu’un économiste ou que le “bon parent” (à préférer à la notion un peu suspecte de “bon père de famille” à qui l’on attribuait la gestion du patrimoine familial). Pour un juriste, c’est un contenant qui peut comprendre beaucoup de biens différents. Quand il s’agit de spécifier ses éléments et l’évolution de ses composants, les choses peuvent s’avérer plus ardues.

La notion de patrimoine semble évidente, tant pour un juriste qu’un économiste ou que le “bon parent” (à préférer à la notion un peu suspecte de “bon père de famille” à qui l’on attribuait la gestion du patrimoine familial). Pour un juriste, c’est un contenant qui peut comprendre beaucoup de biens différents. Quand il s’agit de spécifier ses éléments et l’évolution de ses composants, les choses peuvent s’avérer plus ardues.

Introduite auprès des étudiants dans le cadre des premiers cours de droit civil, revue ensuite dans le cadre du cours de droit patrimonial de la famille et en particulier des successions, cette notion de patrimoine est peu étudiée dans le cadre du droit économique (et du travail) qui s’intéresse à l’entreprise, à sa structure, ses ressources, ses relations avec les travailleurs, fournisseurs, distributeurs, consommateurs et concurrents.

Que peut-on ranger sous cette notion ? Certes, les principes du droit civil nous apprennent qu’il s’agit d’une universalité, mais cela n’aide pas pour établir son contenu.

Aujourd’hui, c’est le droit comptable qui s’intéresse le plus près à cette notion, un peu délaissée par d’autres branches du droit économique – au point qu’il n’existe généralement pas de matière ou de cours de « patrimoine de l’entreprise ». L’article 3 de l’arrêté royal du 12 septembre 1983 déterminant la teneur et la présentation d’un plan comptable minimum normalisé[1]dispose que le «libellé des comptes prévus au plan comptable minimum normalisé peut être adapté aux caractéristiques propres de l’activité, du patrimoine et des produits et charges de l’entreprise. »[2] Il reviendrait alors, aux comptables d’établir une liste positive des éléments à prendre en compte. La même disposition autorise une flexibilité pour les entreprises dans la liste des éléments qu’elles souhaitent y mettre.

Aujourd’hui, les études juridiques visant à définir ce que comprend le patrimoine de l’entreprise sont rares[3]. En droit belge, ces études concernent principalement (sinon exclusivement) la notion de fonds de commerce et sa valorisation comptable par le biais du goodwill. A défaut d’être définie par la législation, doctrine et jurisprudence y incluent l’ensemble des éléments « actifs, matériels et immatériels affectés par un commerçant à l’exploitation de son activité commerciale afin de constituer et maintenir une clientèle»[4]. La valeur de ce fonds de commerce est celle de ses composantes prises isolément ainsi que le goodwill, c’est-à-dire la « puissance de production qui caractérise l’ensemble » de ces composantes[5]. Cette notion, ouverte, est en principe laissée à la libre définition de chaque entreprise[6].

Avant son abrogation au premier janvier 2018, l’article 2 de la loi du 25 octobre 1919 sur la mise en gage du fonds de commerce, l’escompte et le gage de la facture, ainsi que l’agréation et l’expertise des fournitures faites directement à la consommation énumère, de façon non exhaustive, les éléments composant le fonds de commerce : la clientèle, l’enseigne commerciale, le nom commercial, les droit sur la marque, l’organisation commerciale, les droits de créance, les biens meubles, les marchandises et matières premières.

Toutefois, lors d’une cession du patrimoine (ou d’une faillite), il est nécessaire de pouvoir lister les éléments de cette universalité – pour savoir établir ce qui doit être cédé (ou revendu).

Plusieurs questions se posent à cet égard quand on songe au processus de digitalisation à l’oeuvre dans les entreprises comme ailleurs et à l’apparition de nouveaux biens (ou valeurs) liés aux connaissances et aux données.

Si pour les droits de propriété intellectuelle, les choses sont plus ou moins claires car les législations en la matière déterminent en principe de manière claire quel est l’objet du droit, qui en est titulaire, de quelles prérogatives il dispose et pour combien de temps et quel espace, cela est nettement moins vrai sur d’autres biens immatériels (ou propriétés intellectuelles en devenir). Et il y a en outre ce que l’on peut sans doute appeler des droits de propriété « numérique » qui résultent d’une première occupation (par ex. d’un nom de domaine).

Cette question n’est pas purement théorique : elle a des implications concrètes. Par exemple, les bitcoins dont disposerait une société qui serait impliquée dans un système de blanchiment d’argent sont-ils saisissables (en tant que valeur patrimoniale) ? Ou bien s’agit-il simplement de données (sans valeur patrimoniale) ?[7]

Similairement, la qualification d’une “vie” complémentaire sur certains jeux en ligne revêt une importance en terme de licences et de garanties de protection des consommateurs. Ces vies constituent-elles des “biens digitaux” consomptibles ? Ou bien s’agit-il plutôt d’un service offert au titulaire du compte consistant en “une chance de jouer” complémentaire qui nécessite, le cas échéant, une licence pour le jeu de hasard (en ligne) ?[8]

Aussi, le patrimoine nécessite une qualification et une énumération adéquate. Certains auteurs s’y sont essayés en droit étranger, par exemple en droit québécois.[9] Les patricularismes régionaux doivent cependant être pris en considération. Ce qui nous suggère quelques questions auxquelles il vous est demandé de répondre ci-dessous:

1. Après avoir parcouru l’énumération des nouveaux biens en droit canadien/québécois (voir l’article de S. Normand), pouvez-vous tout d’abord identifier des biens (ou propriétés) équivalents en droit belge ? Y a-t-il des biens qui ne sont pas reconnus en droit belge ou, inversement, d’autres biens reconnus en droit belge mais non énumérés ?

2. Quels sont les biens (et propriétés) qui intéressent les entreprises (et les personnes morales) et font partie de leur patrimoine ? Outre une énumération de ces biens, Il serait utile d’indiquer les sources légales (voire jurisprudentielles) des principaux biens d’entreprise qui constituent les équivalents en droit belge.

3. Choisissez un droit de propriété intellectuelle ou un autre « nouveau » bien important pour l’entreprise. Avez-vous une idée de la façon dont on l’évalue dans le patrimoine de l’entreprise ? La réponse sur ce dernier point peut être brève.

Merci d’avance!

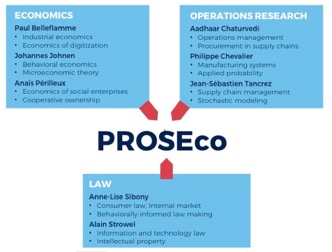

Enguerrand Marique et Alain Strowel

[1] M.B. 29.09.1983

[2] Voy. également l’art. 105 du code des sociétés (MB 6 aout 1999) et l’art. 24 de l’arrêté royal du 30 janvier 2001 portant exécution du code des sociétés qui prévoit (MB 6 février 2001) qui prévoient également ce rôle de la comptabilité dans l’établissement d’une image (fidèle) du patrimoine des sociétés.

[3] Voy. par exemple E. Blary-Clément et F. Plackeel, Le patrimoine de l’entreprise : d’une réalité économique à un concept juridique, Larcier, Bruxelles, 2014.

[4] H. JACQUEMIN et al.., Manuel du droit de l’entreprise, Limal, Anthemis, 2015, p. 377.

[5] Cass., 4 février 1954, J.CB., 1955, p. 368 et R.P.D.B, n° 6, p. 796

[6] Idem, p. 379.

[7] S. Royer, “Bitcoins in het Belgische Strafrecht en Strafprocesrecht”, R.W., 2016/13, 483-501.

[8] Voy. par exemple cette étude de l’Australian Senate Committees on Environment and Comunication. Voy. également les conclusions de la Commission belge des Jeux de Hasard sur le sujet.

[9] S. Normand, Les nouveaux biens, Revue du Notariat, 2004/2, pp. 179 et s.

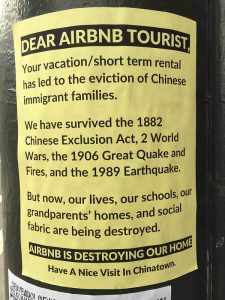

Ce système automatisé d’admission dans l’enseignement supérieur doit en principe “permettre à un maximum d’étudiants d’obtenir leur premier vœu. Mais lorsque les candidats sont trop nombreux pour la même formation (on parle de formation “en tension”), l’algorithme d’APB opère une sélection. Et ce, alors que le Code de l’éducation nationale garantit normalement à tout bachelier

Ce système automatisé d’admission dans l’enseignement supérieur doit en principe “permettre à un maximum d’étudiants d’obtenir leur premier vœu. Mais lorsque les candidats sont trop nombreux pour la même formation (on parle de formation “en tension”), l’algorithme d’APB opère une sélection. Et ce, alors que le Code de l’éducation nationale garantit normalement à tout bachelier